By: Retain Media – retainmedia.com.au

The Q3 2025 Marine Market Brand Consideration Report from Retain Media provides a comprehensive analysis of consumer interest across Australia’s marine sector.

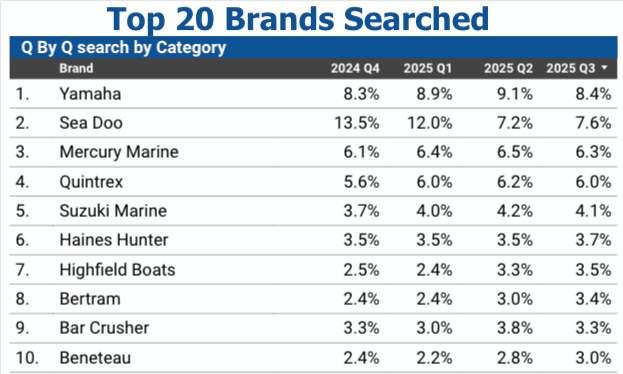

Based on more than 1.19 million search queries collected throughout the quarter, this report reveals the most searched marine brands nationally as the market heads into the prime of the 2025 boating season.

Key Findings Include:

- Yamaha retained the top position it claimed last quarter with 8.4% search share, declining 7.6% from Q2 but maintaining stable performance throughout the year, sitting just 0.1 percentage points above year-ago levels.

- Sea Doo rebounded to second place with 7.6%, posting a 5.5% relative increase from Q2. The personal watercraft specialist has recovered from its dramatic Q2 decline, suggesting renewed interest as the Australian summer approaches, though it remains 5.9 percentage points below year-ago levels.

- Highfield Boats posted substantial gains, jumping from 3.3% to 3.5%, a 6% relative increase that builds on last quarter’s exceptional 40.3% surge. The inflatable boat specialist has gained one percentage point since Q4 2024, reflecting sustained interest in rigid inflatable boats.

- Bar Crusher experienced a significant correction, falling from 3.8% to 3.3%, a 13.1% relative decrease following last quarter’s exceptional 25.9% surge. Representatives attributed Q2’s increased search activity to exceptional sales achievements from both the Tasmanian Agfest and Queensland’s SCIBS displays.

- Bayliner posted exceptional gains, surging from 1.5% to 1.8%, a 20% relative increase that represents the category’s second strongest performance and returns it to the levels it held in Q4 2024 and Q1 2025.

The report also highlights steady growth from Mercury Marine (6.3%), Quintrex (6%), and Haines Hunter (3.7%), whilst Honda Marine’s steady quarterly gains of 0.1 percentage points positioned it at 13th in the rankings, possibly driven by the 2024 release of their new 350HP V8 outboard and the recent launch of their all-new V6 range.

“Q3 2025 marine market results reveal a sector settling into more predictable patterns after the volatility of earlier quarters,” said Brian Sullivan, Director at Retain Media. “Yamaha’s continued leadership and Sea Doo’s modest recovery suggest the personal watercraft market is stabilising, whilst the strong performance from Highfield Boats demonstrates that last quarter’s surges weren’t merely temporary spikes but reflect sustained consumer interest in inflatable boat segments.”

Q3 2025 Marine Market Brand Consideration Report

Welcome to the third edition of our Marine Market Brand Consideration Report, tracking search volume share across Australia’s leading marine brands as we head into the prime of the 2025 boating season.

Q3 2025 delivered a quarter of modest corrections and recoveries, with Yamaha maintaining the top position it claimed last quarter, whilst Sea Doo posted a small rebound after its dramatic Q2 decline. Luxury and performance segments showed mixed results, and brands like Highfield Boats extended their previous momentum, whilst Bar Crusher experienced a significant correction following last quarter’s exceptional surge.

From established engine manufacturers to boutique boat builders, the third quarter revealed a market finding its rhythm as operators and consumers prepare for the Australian summer. Read on for our comprehensive breakdown of who’s gaining ground and who’s consolidating in Australia’s dynamic marine market.

A Note on Methodology

As with our other market reports, the marine market report leveraged several keyword research tools to track search volume across Australia over the past 12 months. This quarter, our research comprised 89 marine brands, 30,769 search terms, and more than 1.19 million searches across the quarter.

As always, our approach to searches included brand terms, dealer terms (if the dealer name contains the brand), brand + location, brand + dealer, brand + category/subcategory, brand + reviews, and variations of the above. We excluded searches mentioning parts/accessories, used equipment listings, rental services, and general maintenance terms to focus on brand consideration rather than service-related queries.

The Most-Searched Marine Brands in Australia

Yamaha retained its position as Australia’s most-searched marine brand with 8.4% in Q3 2025, representing a 7.6% relative decline from 9.1% in Q2. After claiming the top spot for the first time last quarter, the Japanese manufacturer’s lead remains solid despite the quarterly softening, maintaining its reputation as the go-to choice for outboard engines across recreational and commercial applications. Looking back to Q4 2024, when Yamaha held 8.3%, the brand has demonstrated relatively stable performance throughout the year, with its current position sitting just 0.1 percentage points above year-ago levels.

Sea Doo rebounded to second place with 7.6% in Q3, posting a 5.5% relative increase from 7.2% in Q2. The personal watercraft specialist has experienced a volatile journey through 2025, plummeting from 13.5% in Q4 2024 to 7.2% by Q2 2025, before this quarter’s modest recovery. Despite sitting 5.9 percentage points below year-ago levels, the recent uptick suggests seasonal fluctuations in the water sports segment, with renewed interest as the Australian summer approaches.

Mercury Marine held third with 6.3%, declining from 6.5% in Q2. The American marine propulsion manufacturer has shown steady growth since Q4 2024, when it held 6.1%, climbing 0.2 percentage points over the year despite the modest quarterly pullback.

We must always consider that most mainstream market trends have fallen since the COVID anomaly, affecting the sales numbers of almost all marine products, including marine propulsion. BoatIndustry.com reported, “The Brunswick Group’s propulsion division, led by Mercury Marine, reported a 23% drop in sales, from $751.6 million in 2023 to $578.2 million in 2024 in the first quarter. Outboard motors accounted for $450.5 million, down 24%, while sterndrive motors fell 29% to $37.3 million.” These figures include Mercury’s entire product range, including the overall outboard, inboard, and stern drive range.

That said, repower figures remain strong, keeping engine suppliers, including Suzuki, motivated with the popularity of the ‘old school’ style rebuilds. Plus, boat owners may choose to repower their existing rigs instead of committing to higher-priced upgrades to their entire rigs. Suzuki Marine has increased to 4.1% from 3.7% in Q4 2024, demonstrating a steady upward trajectory despite the quarterly softening.

Quintrex slipped to 6% in Q3 from 6.2% in Q2, a 3.2% relative decrease. However, the iconic Australian boat builder has strengthened its position since Q4 2024, when it held 5.6%, marking a 0.4 percentage point gain reflecting solid year-on-year momentum.

Haines Hunter advanced to 3.7% from 3.5%, a 5.7% relative increase that marks its first period of growth after three quarters of stability.

Highfield Boats delivered substantial gains, jumping from 3.3% in Q2 to 3.5% in Q3, a 6% relative increase that builds on last quarter’s exceptional 40.3% surge. The inflatable boat specialist has posted an impressive 12-month growth of 2.5% in Q4 2024, marking a one percentage point gain that reflects sustained interest in rigid inflatable boats.

Bertram posted the top 10’s strongest performance, surging from 3% to 3.4%, a 13.3% relative increase that extends the momentum from last quarter’s 25.2% gain. Since Q4 2024, when the legendary name held 2.5%, Bertram has climbed 0.9 percentage points. As noted last quarter, while the brand itself is no longer marketed in Australia, the term ‘Bertram’ commonly generically describes flybridge cruiser styles, keeping the name prominent in search behaviour.

Bar Crusher experienced a significant correction, falling from 3.8% in Q2 (2025) to 3.3% in Q3, a 13.1% relative decrease that follows last quarter’s exceptional 25.9% surge in the performance fishing boat segment. Despite this pullback, the Australian aluminium boat manufacturer still sits in the same position it held in Q4 2024. Speaking with representatives, the increased search during the last quarter may be attributed to exceptional sales achievements from both the Tasmanian Agfest and Queensland’s SCIBS (Sanctuary Cove International Boat Show) displays.

Beneteau rounded out the top 10 with 3%, gaining 7.1% from 2.8% in Q2. The international sail and powerboat manufacturer has climbed 0.6 percentage points since Q4 2024, when it held 2.4%, reflecting steady growth over the past year.

The Rest of the Top 20

Volvo Penta who are more closely aligned with the larger moored craft, Inboard Performance System (IPS – commonly pod) and stern drive vessels, advanced to 2.9% in Q3 2025 from 2.8% in Q2, a 3.5% relative increase, whilst Stabicraft declined to 2.8% from 3%, a 6.6% relative decrease.

Honda Marine’s search share ticked up slightly from 2.6% to 2.7%, and it has gained 0.1 points each quarter over the past 12 months, positioning it at 13th in our rankings. This success has possibly beeb driven by the 2024 release of their new 350HP outboard built on an entirely new V8 platform, which created a lot of interest, plus the even more recent release of the all-new V6 175, 200, 225 and 250’s.

Riviera has fluctuated slightly over the past 12 months, and ended Q3 down 0.1 points on its Q2 result of 2.7%, although that still leaves it ahead of where it was a year ago. Sunseeker has similarly fluctuated throughout the last 12-month period, with its 2% Q3 result marking a 16.6% relative decrease from the 2.4% it held in Q4 2024.

Jeanneau Boats continued an overall upward trend, finally hitting the 2% mark in Q3 2025, whilst Sea Ray remained dead stable from quarter-to-quarter, with only a 0.2 point fluctuation throughout the previous 12 months.

Bayliner posted exceptional gains, surging from 1.5% to 1.8%, a 20% relative increase in the last quarter. That represents the category’s second-strongest performance, and returns it to the levels it held in Q4 2024 and Q1 2025, after last quarter’s 16.6% decline.

Malibu Boats declined from 1.8% to 1.7%, a relative decrease that continues the brand’s struggles following last quarter’s sharp 37.9% correction, whilst Haines Signature held steady at 1.4%, a result it has recorded for three consecutive quarters.

Beyond the Top 20: Notable Movers

Evolution Boats doubled its search share from 0.1% to 0.2%, a 100% relative increase that, whilst representing a modest absolute share, signals growing interest in the Australian boat builder’s offerings. We can’t help but wonder if these search figures are indicative of the naming similarity with the rising popularity of Evolution Marine, a completely separate entity, also Melbourne-based.

Fairline rose from 0.4% to 0.5%, a 25% relative increase that reflects steady momentum for the British luxury yacht manufacturer in the Australian market.

Sea Jay climbed from 0.4% to 0.5%, a 25% relative increase that demonstrates continued appeal for the Queensland-based aluminium boat builder’s practical fishing and recreational vessels.

Retain Media for Industry-Leading Insights

The Q3 2025 marine market results reveal a sector settling into more predictable patterns after the volatility of earlier quarters. Yamaha’s continued leadership and Sea Doo’s modest recovery suggest the personal watercraft market is stabilising, whilst the strong performance from Highfield Boats demonstrates that last quarter’s surges weren’t merely temporary spikes but reflect sustained consumer interest in inflatable boat segments.

The corrections experienced by Bar Crusher and Malibu Boats, alongside the impressive recoveries from Sunseeker and Bayliner, point to a market where quarterly fluctuations are increasingly driven by seasonal factors and inventory dynamics rather than fundamental shifts in brand preference. Understanding these patterns becomes essential for manufacturers and dealers planning their strategic positioning as we move deeper into the summer boating season.

Keep an eye on our next quarterly update as we track how these trends develop through the peak summer period. In the meantime, check out our other market reports for comprehensive insights into Australia’s automotive industry, including the caravan market, agricultural market, motorbike market, and truck market.

Report summary and author contact details : https://retainmedia.com.au/market-reports/marine-market/q3-2025-marine-market-brand-consideration-report/

For more information about Retain Media – visit their website HERE