New data analysis reveals luxury property sales are booming across Australia with the price tag for a bougie home now starting at $2.52 million – up 72 per cent from 10 years ago.

The second edition of Australia’s Luxury Report 2025 by Ray White, brings together comprehensive analysis from an expert in-house research team to examine not just what defines luxury today, but also who is buying it, how it’s being designed, and where the growth markets are emerging across Australia.

The report shows that Sydney remains Australia’s most expensive market, where luxury begins at $4 million.

Surprisingly, Gold Coast has now taken second place at $2.6 million, pushing ahead of Melbourne’s $2.49 million entry point.

Ray White Chief Economist Nerida Conisbee

In the report, Ray White Chief Economist Nerida Conisbee provides detailed economic analysis of the architectural and landscape features that characterise Australia’s most expensive homes, while Head of Research Vanessa Rader explores the fascinating intersection between high-end retail and premium real estate, as well as the transformative impact of wellness features on luxury property values.

Senior Data Analyst Atom Go Tian offers valuable insights into who’s buying luxury properties, how we define luxury across different markets, and which luxury growth markets are showing the strongest momentum.

“More than just a price point, luxury represents the pinnacle of craftsmanship, attention to detail, and scarcity within a market,” Mr Go Tian said.

“It varies dramatically by location; what’s considered standard in Sydney might be exceptional elsewhere in Australia.”

Mr Go Tian said: “True luxury in real estate combines premium materials, architectural distinction, prime location, and limited availability”.

Senior Data Analyst Atom Go Tian

“As our data reveals, the concept of luxury continues to transform across Australia’s diverse regions, shaped by changing demographics, wealth distribution, and lifestyle preferences.

“From a national perspective, luxury properties in Australia now command prices exceeding $2.52 million, representing a 72 per cent increase from $1.49 million a decade ago.”

Mr Go Tian said a staggering $663 million changed hands across just 20 transactions, revealing not only where Australia’s wealthiest choose to live, but also who they are and how their wealth was created.

“Eastern Sydney continues to be the place to be, with the Double Bay-Bellevue Hill and Rose Bay-Vaucluse-Watsons Bay enclaves accounting for more than half of all top transactions,” he said.

“Bellevue Hill alone appears five times on the list, while Vaucluse claims four spots. Beyond Sydney’s harbour views, Melbourne’s old-money suburbs of Toorak and Brighton each secured positions, while lifestyle destinations like Noosa Heads, Byron Bay, and Portsea also featured prominently.”

The crown jewel of these transactions stands as “Alcooringa,” a Spanish Mission-style residence perched majestically at 27 Victoria Road, Bellevue Hill. Top agent Ashley Bierman of Ray White Double Bay negotiated this off-market sale.

The architectural masterpiece (above) commanded an eye-watering $80 million; a figure that towers over even its closest competitor by $30 million.

Ashley Bierman of Ray White Double Bay

Mr Go Tian said expensive homes are changing hands in new ways.

“Today’s ultra-luxury property buyers are primarily self-made business owners, especially those who built digital and tech companies, rather than corporate executives who once dominated this market,” Mr Go Tian said.

“The wealth behind these purchases now comes from a much wider range of industries, with online businesses and technology ventures leading the way.”

An analysis of this year’s top 20 sales reveals today’s luxury purchasers are predominantly self-made entrepreneurs from diverse sectors including e-commerce, property development, financial services, fashion, and technology.

While buyers in their late 40s to 50s continue to form the core market, we’re witnessing increasing participation from millennial entrepreneurs, particularly those who have built wealth through digital businesses.

Perth demonstrates exceptional momentum with all three of its luxury suburbs ranking in the top 10 nationwide for price growth, led by Nedlands-Dalkeith-Crawley at 8.8 per cent.

Meanwhile, Melbourne’s luxury market shows signs of cooling, with several premium suburbs experiencing price declines – a stark contrast to the heated Queensland market.

The report shows the architectural and landscape features of Australia’s most expensive homes reveal sophisticated investment priorities, with wellness facilities, sustainable elements, and indoor-outdoor integration now considered essential rather than optional.

Properties with comprehensive wellness features command price premiums of 10-25 per cent, reflecting a fundamental shift in what constitutes luxury in today’s market.

Ray White Group managing director Dan White said: “This report also examines parallel luxury markets, particularly the marine industry, which offers valuable insights into wealth distribution and consumption patterns among Australia’s affluent.”

The Australian marine industry: key trends and market insights

Article by Vanessa Rader, Ray White Group Head of Research

As the luxury property market continues to evolve in Australia, the marine industry represents a parallel ecosystem of high-value assets that offers fascinating insights into wealth distribution, consumer preferences, and emerging technologies. For those tracking Australia’s premium lifestyle sectors, understanding the marine industry’s trajectory provides valuable context about how affluent Australians are choosing to invest and enjoy their prosperity.

Australia’s marine industry continues to thrive in 2025, with over 2,000 businesses generating $10.12 billion in turnover – a 5 per cent increase from 2023. The data paints a vivid picture of a nation deeply connected to its waterways. With 2.5 million Australians holding boat licences (one in ten citizens) highlighting boating as one of the nation’s leading pastimes, the sector has become a cornerstone of Australia’s outdoor lifestyle economy.

What makes this industry particularly noteworthy for observers of luxury markets is how the patterns of ownership, the shift in vessel preferences, and the demographic changes among buyers mirror, and sometimes anticipate, broader trends in premium asset ownership. From cryptocurrency wealth to sustainability concerns, the marine sector offers a microcosm of Australia’s evolving relationship with luxury.

Market dynamics and buyer profiles

The Australian boating market shows distinct regional differences, according to Ray White Marine CEO Brock Rodwell.

“Sydney is characterised by institutional wealth with buyers typically from blue chip office locations,” Rodwell explains, while the Gold Coast represents “a younger market that’s a bit more flashy” with more finance involvement.

Surprisingly, “Melbourne has the highest concentration of larger vessel registrations, though many of these vessels are kept overseas,” notes Rodwell. Meanwhile, Perth is emerging as a growth market centred around affluent areas like Peppermint Grove and Claremont, with buyers largely from mining and agriculture sectors.

Post-COVID, the industry has witnessed a shift in buyer demographics. “We’ve done one or two Bitcoin deals,” reports Rodwell, noting the emergence of tech entrepreneurs in the market. “During COVID, because digital entrepreneurs just skyrocketed, we saw younger buyers purchasing more expensive boats.”

While family decisions remain common in boat purchases, Rodwell observes more solo purchasers emerging: “Younger wealthy tech guys and entrepreneurs make solo decisions.”

Key trends shaping the market

Larger vessels with apartment-style living

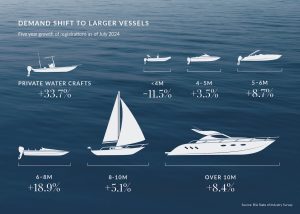

The most significant trend is the shift toward larger vessels. Data shows boats in the 6-8m category experiencing 18.9 per cent growth over five years, followed by vessels over 10m (+8.4 per cent).

“Our average new boat size used to be about 50 foot and now it’s probably 70 foot,” Rodwell reports. “People after COVID want to stay on the boats longer and want further range.” This has created infrastructure challenges in Sydney, where berthing facilities are limited.

Australian buyers increasingly prefer “apartment-style living” on the water, with distinct layout preferences. “The Australian trend is they like having a raised galley. They like entertaining and cooking and preparing,” explains Rodwell, contrasting with traditional European layouts where galleys are located below deck.

Hybrid propulsion and sustainability

The marine market is experiencing a surge in hybrid propulsion systems, combining traditional engines with electric motors and battery storage. These options now account for nearly 15 per cent of new boat sales in the 6-8m category, up from just three per cent in 2023.

“A lot of companies are doing hybrid models because the emissions have to come down,” Rodwell explains. “In Europe, you’ve got certain zones where you can’t go into national parks if you’ve got diesel engines.”

Advanced solar technology is also transforming the market: “You’ve got solar panels that are infused in the hull with unlimited range. As long as you’ve got some sunlight, you can just motor on.”

Currency fluctuations and market opportunities

Currency fluctuations significantly impact the market in 2025. “Foreign exchange rates can be difficult to navigate because our deals often involve euros and USD,” Rodwell explains.

However, this creates opportunities for Australian listings. “With the exchange rates where they are, people are focussing back on the local listings,” Rodwell notes. “Once you pay freight, duty, GST, and the currency, those local boats are looking more attractive.”

This is drawing international attention to Australian vessels. “When you tell them you’re saving a million or two just on the currency by itself, that pays for the shipping,” which can cost “between $100,000 to $250,000” depending on vessel size.

Innovative sales approaches

The industry is embracing new sales strategies, with Ray White Marine pioneering boat auctions at boat shows. “We’ve got six boats going in the Sanctuary Cove boat show and we’re auctioning two on the first day,” says Rodwell.

This auction approach mirrors real estate strategies: “It only works if you’ve got a genuine vendor ready to get it done. You need the reports that everyone wants because it’s 10 per cent on the day and five days settlement.”

Looking ahead

As we look toward the horizon for Australia’s marine industry, the confluence of larger vessels, advanced technology, and innovative sales methods creates a perfect environment for sustained growth. With hybrid propulsion technology rapidly gaining acceptance and Australian listings becoming more attractive to international buyers due to currency advantages, the industry is navigating toward a promising future.

The evolution toward more sophisticated, environmentally-conscious boating experiences aligns perfectly with Australia’s natural advantages – its vast coastline, diverse waterways, and outdoor lifestyle culture – positioning the Australian marine industry as an increasingly important player in the global market.

For investors, property professionals, and luxury market observers, the marine sector’s trajectory offers valuable insights. The parallels between high- end vessel ownership and premium property acquisition are striking, both markets are seeing similar buyer demographic shifts, sustainability concerns, and design preferences. As these twin pillars of Australia’s luxury lifestyle economy continue to evolve, they will likely influence each other in increasingly significant ways, creating new opportunities for cross-sector collaboration, investment, and innovation in the years ahead.

For more information contact Brock Rodwell at or visit their website at www.raywhitemarine.com