By: Retain Media – retainmedia.com.au

The Q4 2025 Marine Market Brand Consideration Report from Retain Media provides a detailed snapshot of consumer interest across Australia’s marine sector. Based on more than 1.4 million search queries collected throughout the quarter, this comprehensive report reveals the most-searched marine brands nationally, highlighting distinct patterns across market segments as luxury yacht manufacturers posted consistent gains whilst performance boats experienced significant volatility.

Key Findings Include:

Luxury yacht segment showed collective strength, with Sunseeker climbing 18.2% from 2.2% to 2.6%, Australian manufacturer Riviera rising 4.3% to reach 2.4%, and Sea Ray surging 21.1% from 1.9% to 2.3%, suggesting the premium end of the market is weathering economic headwinds more effectively than mid-tier manufacturers.

Performance boats demonstrated extreme volatility, with Malibu Boats delivering a dramatic 58.8% recovery surge from 1.7% to 2.7% after two consecutive quarters of decline, whilst Mastercraft bounced 40.0% from 1.0% to 1.4% after hitting its year-low in Q3. Nautique posted the most dramatic movement outside the top 20, surging 44.4% from 0.9% to 1.3%.

Propulsion brands maintained remarkable stability, with Yamaha holding the highest position in marine propulsion brands and 2nd overall at 8.2% (just 0.3 percentage points below its Q1 baseline), in second position (3rd overall) Mercury Marine at 6.5%, and the 1.7 percentage point gap between the two leaders remaining stable throughout 2025, suggesting entrenched brand preferences in the outboard motor market

Sea-Doo dominated Q4 with 11.2%, posting a 51.4% relative increase from 7.4% in Q3 as summer boating season drove strong seasonal interest in personal watercraft.

Quintrex maintained its position as Australia’s favourite trailer boat brand with 6.1%, commanding nearly double the search interest of its closest rival, Haines Hunte,r despite a 21.8% quarterly pullback from its exceptional Q3 result.

Haines Hunter posted its weakest quarter of 2025 at 3.5%, though the devastating factory fire on 9 January 2026 is expected to drive substantial search spikes in Q1 2026 as customers and industry stakeholders seek information about production timelines.

The report also highlights interesting dynamics in the wake boat segment, with brands like Nautique and Mastercraft demonstrating that recreational performance boats prove far more susceptible to seasonal sentiment and economic conditions than essential components like outboard motors.

“Q4 2025 captured Australia’s marine market at its seasonal peak, revealing distinct patterns across categories,” said Brian Sullivan, Director at Retain Media. “The stark contrast between propulsion brand stability and performance boat volatility highlights a fundamental market truth: essential components like outboard motors generate steady, entrenched brand preferences, whilst discretionary recreational purchases like ski and wakeboard boats prove far more susceptible to seasonal sentiment and economic conditions. Meanwhile, the luxury yacht segment’s collective strength suggests the premium market is insulated from the pressures affecting mid-tier manufacturers.”

For a full breakdown of the report’s findings, including search share insights for 94 brands and over 31,000 keywords, download the full Q4 2025 Marine Market Brand Consideration Report below:

Click here to view the full reportA Note on Methodology

This report was produced using a range of keyword research tools to assess search volume across Australia for Q4 2025. Our dataset included 94 marine brands, 31,119 relevant keywords, and a total of 1,472,917 searches across the quarter.

Bear’s State of the Industry

Australian fishing and boating legend John ‘Bear’ Willis is back to give us his take on the industry and the Q4 results as we launch into 2026.

It’s summer holidays, and our boat ramps at every holiday destination are packed. It is certainly a great time for our marine industry, but it can also be very demanding, especially on service and accessories, staff and facilities.

As I look out my office window here on the NSW South Coast, I have a heart-warming view of a multi-generational family all gathered for their annual break. This is a long-standing Quintrex family that has its 1970s Cruiseabout out of its storage for its annual revival, alongside grandpa’s 520 Coast Runner, a brand new 490 Cruiseabout Bowrider for his son, a 450 Fishabout for the nephew, and one of the sons-in-law visits regularly with his 420 Dory. It’s little wonder that Australia’s favourite boat brand continues to produce the lion’s share of search results in trailer boats, constantly returning over 6% (6.1% last quarter, and 7.8% in Q3) of enquiries, almost doubling its closest rival, Haines Hunter, returning 3.5% of search results.

Upon speaking with Telwater (Quintrex owners) representatives about their Q3 search share result, they revealed that they actually prompted their dealers to reduce their boat show representation during the quarter and assisted them in promoting their own in-house boat shows. Telwater supported dealers with large marketing campaigns throughout the country, and we must assume that the change in direction worked in their favour (at least in terms of brand awareness) as evidenced by their surge in search numbers. It’s an interesting revelation, and one that shows just how beneficial a willingness to change your promotional approach can be.

Speaking of Haines Hunter, we expect their search volume to peak in the next quarter following news of a devastating fire at their manufacturing plant on January 9.

In a press release, Haines Hunter’s Managing Director, John Haber, stated:

“We are fortunate that the majority of our Haines Hunter moulds were not affected by the fire. With the exception of a few that were lost or damaged, our core tooling remains intact, and plans are already in place to rebuild those moulds as quickly as possible.

Over the coming weeks and months, we will be working through the process of rebuilding and restoring our factory. During this time, we will also be strategically planning our best options moving forward—using this moment not just to recover, but to strengthen our operations and position Haines Hunter for an even stronger future.

While this will take time, our focus is clear: to get back on track as soon as possible and rebuild stronger than ever.”

We’ll be monitoring the situation with Haines Hunter closely over the coming months as they seek to reestablish their operations after the fire. In the meantime, dive into the full report below and see how the Australian marine market is faring as we head into 2026. I hope you find it as enlightening as I did.

The Most-Searched Marine Brands in Australia

The Top 10

Sea-Doo absolutely dominated Q4 2025 with 11.2%, posting a remarkable 51.4% relative increase from 7.4% in Q3. The personal watercraft giant’s massive surge reflects the quintessentially seasonal nature of the PWC market, with summer boating season driving strong interest ahead of the holidays. The Q4 result represents Sea-Doo’s strongest quarter of 2025 and sits 0.8 percentage points above its Q1 baseline of 10.4%, demonstrating the brand’s ability to capture peak summer demand.

Yamaha retained second place with 8.2%, declining 7.9% from 8.9% in Q3. Despite the quarterly pullback, Yamaha maintains its position as Australia’s most-searched marine propulsion brand, continuing to dominate the outboard motor category. The brand sits just 0.3 percentage points below its Q1 position of 8.5%, demonstrating remarkable year-long stability.

Mercury Marine held third position with 6.5%, declining 5.8% from 6.9% in Q3. The American propulsion manufacturer continues to trail Yamaha in search interest, sitting 0.3 percentage points below its Q1 baseline of 6.8%. The 1.7 percentage point gap between the two propulsion leaders has remained relatively stable throughout 2025, suggesting entrenched brand preferences in the outboard motor market.

Quintrex pulled back to 6.1%, declining 21.8% from 7.8% in Q3. Despite the quarterly correction, Australia’s favourite trailer boat brand continues to command nearly double the search interest of its closest trailer boat rival, Haines Hunter, maintaining the dominant position it has held throughout 2025.

Suzuki Marine eased to 4.1%, declining 12.8% from 4.7% in Q3. The Japanese propulsion manufacturer sits 0.2 percentage points below its Q1 baseline of 4.3%, experiencing gradual erosion throughout 2025.

Haines Hunter slipped to 3.5%, declining 7.9% from 3.8% in Q3. The Australian trailer boat manufacturer’s Q4 result represents its weakest quarter of 2025, sitting 0.3 percentage points below its Q1 position. With the devastating factory fire occurring on 9 January 2026, we anticipate search interest will spike substantially in Q1 2026 as customers and industry stakeholders seek information about production timelines and the rebuild process.

Bar Crusher posted modest gains, rising 3.0% from 3.3% to 3.4%. The Australian manufacturer sits 0.2 percentage points above its Q1 baseline of 3.2%, demonstrating gradual year-long growth.

Highfield Boats pulled back substantially, declining 20.6% from 3.4% to 2.7%. Despite the quarterly correction, the inflatable boat manufacturer remains 0.3 percentage points above its Q1 position of 2.4%, suggesting the mid-year surge delivered sustained gains.

Malibu Boats delivered a dramatic recovery, surging 58.8% from 1.7% to 2.7%. The ski and wakeboard boat specialist’s exceptional Q4 performance reverses a two-quarter slide and vaults the brand back into the top 10, though it remains 0.4 percentage points below its Q1 baseline of 3.1%.

Stabicraft eased to 2.6%, declining 7.1% from 2.8% in Q3. The New Zealand manufacturer sits 0.3 percentage points below its Q1 position of 2.9%, having experienced a gradual year-long erosion.

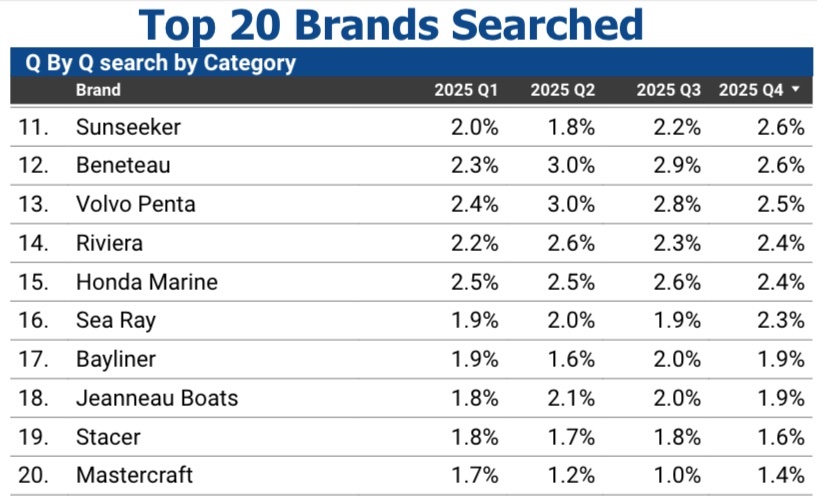

The Rest of the Top 20

Sunseeker posted solid gains, climbing 18.2% from 2.2% to 2.6%. The British luxury yacht manufacturer sits 0.6 percentage points above its Q1 baseline of 2.0%, marking consistent year-long growth.

Beneteau pulled back 10.3% from 2.9% to 2.6%, whilst Volvo Penta similarly declined 10.7% from 2.8% to 2.5%. Both brands experienced mid-year surges that have partially corrected in Q4.

Riviera posted modest gains, rising 4.3% from 2.3% to 2.4%. The Australian luxury yacht manufacturer sits 0.2 percentage points above its Q1 position of 2.2%, demonstrating gradual year-long growth and benefiting from strong export sales in the large boat segment.

Honda Marine eased 7.7% from 2.6% to 2.4%, whilst Sea Ray climbed 21.1% from 1.9% to 2.3%, marking the brand’s strongest quarter of 2025 and sitting 0.4 percentage points above its Q1 baseline.

Bayliner declined 5.0% from 2.0% to 1.9%, holding steady with its Q1 position, whilst Jeanneau Boats slipped 5.0% from 2.0% to 1.9%, sitting 0.1 percentage points above its Q1 baseline of 1.8%.

Stacer declined 11.1% from 1.8% to 1.6%, sitting 0.2 percentage points below its Q1 position, whilst Mastercraft delivered impressive gains, surging 40.0% from 1.0% to 1.4%. Despite the exceptional quarterly performance, the ski boat specialist remains 0.3 percentage points below its Q1 baseline of 1.7%, suggesting the brand has yet to fully recover from its mid-year weakness.

Beyond the Top 20: Notable Movers

Nautique delivered the most dramatic movement outside the top 20, surging 44.4% from 0.9% to 1.3%. The wake boat specialist bounced back strongly after hitting its year-low in Q3, suggesting renewed interest in premium performance boats as summer approached.

Yellowfin experienced a sharp correction, declining 25.0% from 0.8% to 0.6%. The centre console manufacturer gave back all of its mid-year gains, returning to its Q1 baseline and marking one of the steeper pullbacks in the rankings.

Fairline similarly retreated, falling 20.0% from 0.5% to 0.4%. The British luxury yacht builder posted its weakest quarter of 2025, sitting 0.2 percentage points below its Q1 position of 0.6% and extending a three-quarter decline.

Luxury Yachts Gain Ground While Performance Boats Show Volatility

Q4 2025 revealed some intriguing patterns beyond the headline figures, with the luxury yacht segment delivering consistent gains whilst ski and wakeboard boats experienced significant volatility.

The premium end of the market showed notable strength throughout the quarter. Sunseeker climbed 18.2% from 2.2% to 2.6%, sitting 0.6 percentage points above its Q1 baseline and marking consistent year-long growth. Australian luxury manufacturer Riviera posted modest gains of 4.3% to reach 2.4%, sitting 0.2 percentage points above its Q1 position, whilst Sea Ray surged 21.1% from 1.9% to 2.3%, delivering its strongest quarter of 2025 and sitting 0.4 percentage points above its Q1 baseline. This collective performance suggests the premium segment is weathering economic headwinds more effectively than mid-tier manufacturers, likely benefiting from the strong export sales Bear mentioned in his introduction.

The ski and wakeboard category, by contrast, demonstrated significant volatility that stands in sharp contrast to the stability shown by propulsion brands. Malibu Boats delivered a dramatic 58.8% recovery surge from 1.7% to 2.7% after two consecutive quarters of decline, whilst Mastercraft bounced 40.0% from 1.0% to 1.4% after hitting its year-low in Q3. These dramatic swings suggest the recreational performance boat segment may be more susceptible to seasonal buying patterns or economic sentiment than the broader marine market.

Trust Retain Media for Industry-Leading Insights

Q4 2025 captured Australia’s marine market at its seasonal peak, with personal watercraft dominating summer interest whilst underlying market dynamics revealed distinct patterns across categories. The stark contrast between propulsion brand stability and performance boat volatility highlights a fundamental market truth: essential components like outboard motors generate steady, entrenched brand preferences, whilst discretionary recreational purchases like ski and wakeboard boats prove far more susceptible to seasonal sentiment and economic conditions.

Looking ahead, the Haines Hunter factory fire will be the story to watch in Q1 2026, with crisis-driven search interest expected to reshape the competitive landscape as the industry tracks the manufacturer’s recovery. For brands seeking to understand their competitive position in an increasingly dynamic market, tracking search behaviour remains essential for strategic planning.

For more information about Retain Media – visit their website HERE