Retain Media have released their first edition of the “Marine Market Brand Consideration Report.”

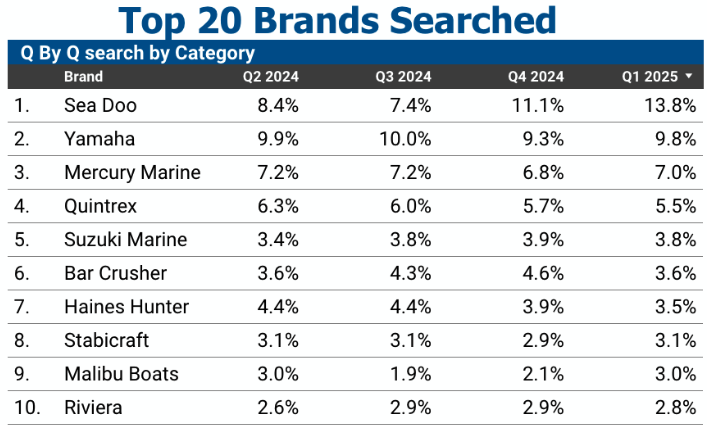

The inaugural Q1 2025 report provides a detailed snapshot of consumer interest across Australia’s marine industry. Based on more than 1.4 million search queries collected throughout the quarter, this comprehensive report reveals the most-searched boat and engine brands nationally, highlighting major movements across the top 20 and beyond.

Some Key Findings Include:

- Sea-Doo surged to the top, recording a 13.8% share of search volume — a 24.3% relative increase quarter-on-quarter and a 64% lift year-on-year, making it the strongest-performing brand in the report.

- Yamaha and Mercury Marine held steady in second and third place respectively, with Yamaha rising to 9.8% (+5.4% relative increase) and Mercury posting a modest 2.9% gain to reach 7.0%.

- Malibu Boats made one of the sharpest comebacks, rising from 2.1% to 3.0% — a 42.9% relative increase, returning the brand to its Q2 2024 standing.

- Bar Crusher and Haines Hunter posted notable declines, with Bar Crusher falling from 4.6% to 3.6% (−21.7% relative decline) and Haines Hunter dropping from 3.9% to 3.5% (−10.3%).

- Nautique, Mustang Boats, and Caribbean Boats led the best-of-the-rest performers, with Nautique rising from 0.7% to 0.9% (+28.5%), and both Mustang and Caribbean recording 25% relative increases.

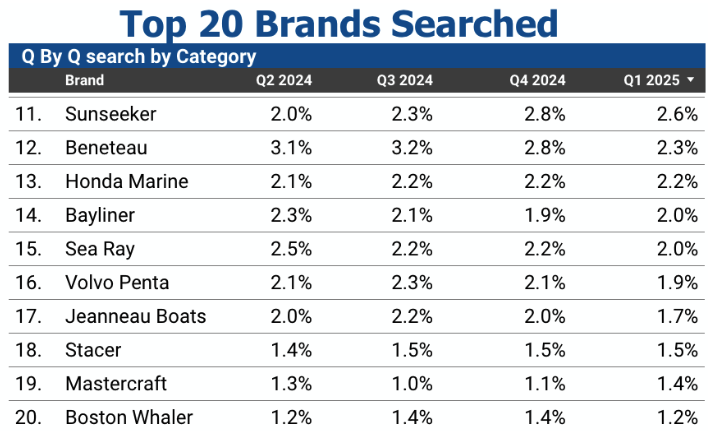

The report also notes consistent performances from Riviera, Sunseeker, and Suzuki Marine, as well as broader softening among luxury and mid-tier international brands including Beneteau, Jeanneau, and Volvo Penta.

They say that “We’ve developed this quarterly series to give manufacturers, dealers, and marine industry stakeholders clearer visibility into how Australian consumers are engaging with the country’s leading marine brands online. Drawing on national search data from the past four quarters, the report tracks how brand consideration is shifting and highlights the brands gaining or losing market attention.

While the marine category has traditionally been one of the more stable sectors, Q1 2025 revealed a noticeable shake-up across the leaderboard. Lifestyle and performance-focused brands made some of the strongest gains this quarter, while a few long-standing names pulled back after a strong run in late 2024.

This report focuses on the top 20 brands by search volume, breaking down the key movements between Q4 2024 and Q1 2025, with additional comparisons to Q2 2024 to provide year-on-year context.”

With brand consideration continuing to fragment — and several challenger brands closing in on the top 20 — Q2 2025 is shaping up to be a pivotal period for visibility, positioning, and search-driven consumer interest.

To read more about their report, visit https://retainmedia.com.au/market-reports/marine-market/q1-2025-marine-market-brand-consideration-report/

The authors say that as this is their first marine market report, they would like to hear from any industry members and would appreciate any feedback or questions you might have.

Please check your company’s status. Contact us with any questions or omissions.

Retain Media can be contacted via their web site retainmedia.com.au or by contacting their Content & Communications Lead, Nick Ainge Roy at or by calling 0414 184 452